- Daly Asset Management

- Posts

- The Turning Point: Why 2026 Starts With Conviction, Not Caution

The Turning Point: Why 2026 Starts With Conviction, Not Caution

Happy New Year! Markets closed 2025 strong—and the setup ahead is even better.

The Daly Asset Management Fund is Officially Live

After months of building, backtesting, and refining, Daly Asset Management is officially live.

You can now invest directly in our systematic, data-driven strategies at dalyassetmanagement.com. This isn't your advisor's 60/40 portfolio. This isn't another closet index fund charging active fees. This is quantitative investing built for sophisticated, self-directed allocators who understand that alpha comes from being systematically contrarian, not chasing whatever CNBC is pumping today.

The market is rotating. Concentration is cracking. And the strategies we've deployed are built for exactly this environment.

Corporate Overview

Happy New Year from the Daly Asset Management team!

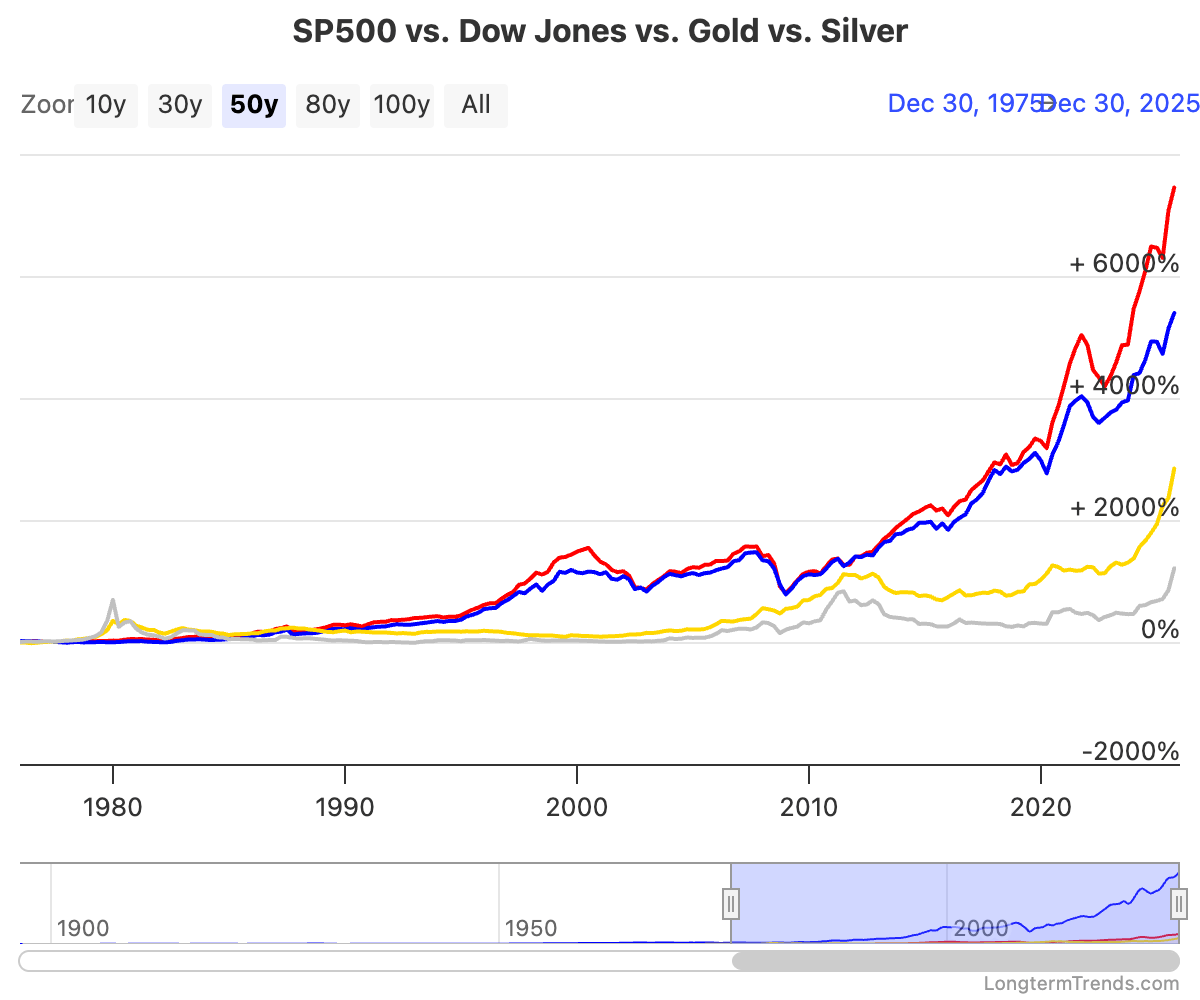

The final trading week of 2025 delivered exactly what holiday markets should: calm, orderly profit-taking as investors closed out another stellar year. The S&P 500 finished 2025 with a +16.4% gain—marking back-to-back years of double-digit returns and proving once again that patient, systematic investors win. The Dow notched eight consecutive winning months, its longest streak since 2018. Gold surged 64%, posting its best year since 1979, while Bitcoin rallied past $88,000.

This wasn't luck—it was a market rewarding innovation, infrastructure investment, and disciplined capital allocation. And 2026? The setup is even more compelling.

Sure, Fed minutes revealed a divided committee and the 10-year yield held near 4.16% as rate cut expectations moderated. But here's what excites us: clarity is emerging. Policymakers are navigating complex crosscurrents—tariffs that are adding modestly to inflation, a labor market that's moderating but not collapsing, and an AI infrastructure boom that's literally reshaping the American economy. This isn't chaos—it's recalibration. And recalibration creates opportunity.

At Daly Asset Management, we start every year the same way: by identifying where the market is mispriced, where structural trends are underappreciated, and where patient capital can generate asymmetric returns. We don't chase headlines or trade on fear. We position portfolios based on where real earnings growth, infrastructure investment, and valuation disconnects create alpha opportunities that others miss.

Welcome to 2026. The year where fundamentals reassert themselves, quality compounds, and independent thinking gets rewarded.

Ready to invest with a team that thinks independently? Explore Daly AM's systematic, data-driven investment strategies at dalyassetmanagement.com.

💡 Stock of the Week: NextEra Energy (NEE)

Ticker: NEE | Sector: Utilities (Electric) | Market Cap: $167B | Dividend Yield: 2.8%

Want to know the most exciting investment theme heading into 2026? It's not another AI software play—it's the infrastructure that powers AI. And that's where NextEra Energy shines.

Big Tech is unleashing $600+ billion on AI infrastructure in 2026, with roughly 75% ($450B) flowing into data centers, servers, and GPUs. But here's what everyone forgets: those data centers consume massive amounts of electricity. U.S. electricity demand is projected to surge over 50% from 2020 levels by 2050, with data centers alone accounting for 12% of total consumption by 2028.

NextEra Energy is perfectly positioned to capitalize. As the nation's largest electric utility and the world's largest generator of renewable energy from wind and solar, NEE operates Florida Power & Light (serving 12 million customers) alongside NextEra Energy Resources. The company combines fortress-like regulated utility cash flows with growth from renewable energy expansion—a rare blend of stability and upside.

The timing couldn't be better. The utilities sector delivered 20.25% total returns in 2025, with Q3 earnings growth hitting 23.1%—and the sector is just getting started. Forward P/E ratios have expanded from 15.8x to 18.5x as the market finally recognizes the structural growth story. Meanwhile, NEE closed the year at $80.41, offering new investors an attractive entry point into America's essential infrastructure backbone.

The macro backdrop is equally compelling: the Fed has cut rates by 175 basis points since September 2024, making high-dividend utilities increasingly attractive as bond proxies. Infrastructure investment is accelerating toward $1 trillion through 2029 to modernize the grid and integrate distributed energy resources. NextEra's guidance implies 8-10% adjusted EPS growth in 2026—impressive for a utility, exceptional when paired with a 2.8% dividend and rock-solid balance sheet.

Risks to Watch

Regulatory pressure: Florida's public service commission could constrain rate increases

Weather volatility: Hurricane exposure remains a tail risk to physical infrastructure

Rate sensitivity: A hawkish Fed pivot could temporarily pressure high-dividend equities

Verdict

We're bullish on NEE because this is where AI meets essential infrastructure. While everyone obsesses over which software company will dominate large language models, we're focused on who's literally keeping the lights on. NextEra offers growth, income, fortress stability, and exposure to the most important secular trend of the decade—all at a valuation that still reflects 2022 skepticism. In a market that's finally waking up to the power demand story, NEE is the smart way to position for the next phase of the AI revolution.

Market Snapshot (Week of Dec 29, 2025 – Jan 2, 2026)

Index/Asset | Close (Jan 2) | Weekly Change | 2025 Full Year |

|---|---|---|---|

S&P 500 | -0.74% | +16.4% | |

Nasdaq Composite | -0.76% | +18.7% | |

Dow Jones | -0.63% | +13.9% | |

Russell 2000 | -0.75% | +11.5% | |

10-Year Treasury Yield | -0.01% | -45bps YTD | |

WTI Crude Oil | Flat (week) | -20.8% YoY | |

Gold | -0.21% | +64% | |

Bitcoin | +1.19% | +125% |

This was textbook year-end tape—light volume, modest profit-taking, and positioning for the new year. The real story is the breadth of 2025's strength: every major index delivered double-digit gains, gold posted its best year since 1979, and silver surged 144%. The compression across indices (Nasdaq vs. Dow) suggests healthy market participation rather than speculative blow-off. Meanwhile, the 10-year yield's stability near 4.16% reflects bond markets pricing in a measured, data-dependent Fed—exactly what healthy markets need.

Market Commentary

The Fed's Productive Debate: Why Disagreement Is Healthy

The FOMC's December meeting featured three dissents—the most since 1988. Some will frame this as chaos. We see it as accountability. A unanimous committee in these conditions would be far more concerning.

Here's what's actually happening: minutes show policymakers are carefully weighing a moderating labor market against inflation that's been stickier than expected. "Most participants judged that further downward adjustments would likely be appropriate if inflation declined as expected," the document states—but the key phrase is "as expected." This is a Fed that's finally learned to be data-dependent rather than reactive.

The result? Markets now price in just 1-2 rate cuts for 2026, down from six cuts anticipated a year ago. That recalibration might feel hawkish, but it's actually stabilizing: businesses can plan, investors can model cash flows, and we avoid the whipsaw volatility of over-promising and under-delivering.

Plus, Jerome Powell's term expires in May 2026, meaning we'll get clarity on leadership early in the year. This reduces rather than increases uncertainty—the market hates ambiguity, and we're about to eliminate a big source of it.

AI Infrastructure: The Supercharger Under the Hood

Let's talk about the most bullish structural trend in the U.S. economy: hyperscalers are deploying $600+ billion on AI infrastructure in 2026, representing a 36% year-over-year increase. Microsoft is spending $120 billion, Amazon $118-125 billion, and Alphabet raised guidance three times to $91-93 billion.

This isn't speculative bubble behavior—it's mission-critical infrastructure investment. Goldman Sachs projects $1.15 trillion in total hyperscaler capex from 2025-2027, more than doubling the prior three-year period. And here's the kicker: this spending contributed 1.2% to U.S. GDP in 2025—that's real economic activity creating real jobs and real productivity gains.

The monetization will come. Global spending on cloud infrastructure services hit $102.6 billion in Q3 2025, up 25% year-over-year. Amazon's Andy Jassy put it perfectly: "The faster we grow, the more capex we spend... we don't procure it unless we see significant signals of demand." This is demand-driven investment, not "build it and they will come" speculation.

The opportunity for investors? Focus on the picks-and-shovels plays: utilities powering data centers, semiconductor equipment, electrical infrastructure, and cloud platform operators with proven monetization. This is a multi-year tailwind that's just getting started.

Quality Rotation: The Market's Smart Money Move

Here's an underappreciated positive: every S&P 500 sector is trading above its 200-day moving average except one—consumer staples. That exception isn't a bug; it's a feature.

When defensive sectors underperform in a bull market, it signals healthy risk appetite and economic confidence. Market analyst JC Parets nailed it: "That's exactly what you want to see in a healthy bull market." Capital is flowing toward companies with operating leverage, earnings momentum, and innovation exposure—textbook risk-on behavior.

But here's where it gets interesting: this rotation has created compelling value in quality defensive names. Utilities delivered 20.25% returns in 2025 with 9.1% projected earnings growth for 2026, yet they're trading at 18% discounts to historical valuations while yielding 2.68%—better than healthcare or staples.

This is growth-plus-income at value prices. When a sector transitions from "boring defense" to "essential infrastructure for AI" and the market hasn't fully repriced it, you lean in.

Trade Policy: Stabilization Ahead

Yes, tariffs have created friction—but let's focus on what's improving. The U.S. and China struck a 90-day truce in May, reducing tariffs from punitive 145% levels to more manageable rates. Deals with the EU, Japan, and South Korea have brought predictability to major trading relationships.

More importantly, the Supreme Court will rule on IEEPA tariff authority in Q1 2026, which will eliminate uncertainty one way or another. Markets hate ambiguity far more than they hate bad news. Getting a definitive ruling—regardless of outcome—allows businesses to plan and capital to deploy.

Meanwhile, U.S. exports to the UK surged 19.4% in 2025 as trade deals kicked in, and LNG exports jumped 22% as Europe diversified from Russian energy. The narrative that trade is collapsing doesn't match the data—it's reshuffling, and smart investors are positioning for the new supply chains.

Small-Caps: Patience Will Be Rewarded

The Russell 2000 gained 11.5% in 2025—solid absolute performance, though it lagged large-caps. Why? Small-caps face higher financing costs, greater tariff exposure, and thinner margins. But here's the opportunity: when the Fed delivers rate cuts later in 2026, small-caps will benefit disproportionately.

Small-cap value is trading at decade lows relative to large-cap growth—not because fundamentals have deteriorated, but because the cost of capital has penalized leverage. As rates normalize, this valuation gap should compress. The play isn't to buy garbage; it's to selectively own quality small-caps with pricing power, clean balance sheets, and domestic revenue exposure ahead of the multiple re-rating.

Tactical Map: Where to Lean In

AI infrastructure beneficiaries (NEE, VST, CEG): Power demand is structural, and valuations are attractive

Gold miners and royalty companies: Central banks added 1,000+ tons in 2025; the bid isn't going away

Dividend growers in quality sectors: Compounders with pricing power win in any environment

LNG exporters and energy infrastructure: U.S. is dominating European gas markets; this is a multi-decade trend

Selective small-cap value: Set the table now for when the Fed delivers multiple cuts mid-year

Theme to Watch: The Infrastructure Renaissance

The most exciting investment theme for 2026 isn't software—it's hard infrastructure. U.S. electricity demand needs to rise 50%+ by 2050, requiring $1 trillion in grid investment through 2029. Data centers, EV charging networks, reshored manufacturing—they all run on electrons.

This creates a multi-year bull market in: (1) utilities with regulatory frameworks that enable capex recovery, (2) transmission and distribution infrastructure, (3) natural gas and nuclear baseload power, and (4) electrical equipment manufacturers. The bottleneck isn't chips or cloud—it's power generation and delivery. Companies solving this problem will compound returns for a decade.

Forward View: January 6-10, 2026

Key Economic Releases:

Jan 7: JOLTS Job Openings – watch for stabilization in labor demand

Jan 10: Nonfarm Payrolls (Dec) – expecting continued moderate growth

Jan 14: CPI (Dec) – consensus is for continued deceleration

Jan 29: FOMC Meeting – no action expected, but forward guidance matters

Earnings Season Kickoff:

Financials report Jan 14-15 (JPM, BAC, C) – expect strong trading revenues

Tech heavy-hitters late January (TSLA, NFLX, MSFT) – AI monetization in focus

Technical Levels:

S&P 500: Support at 6,800, next resistance at 6,950 (prior all-time high)

10-Year Yield: Watching 4.25% breakout level; stability here is constructive

Final Words

What a year 2025 was—and what a setup we have for 2026! Markets delivered broad-based gains, gold hit all-time highs, AI infrastructure investment accelerated, and quality companies proved once again that fundamentals win. As we head into the new year, we're optimistic about the opportunities emerging: utilities trading at value prices while powering the next industrial revolution, infrastructure investments creating real economic growth, and a Fed that's finally found its footing.

At Daly AM, we start every year focused on the same thing: finding where the market is mispriced and positioning client capital for long-term compounding. In 2026, that means infrastructure, quality income streams, and companies solving real problems with pricing power. Happy New Year—let's make this the best year yet.

Invest with conviction. Explore Daly Asset Management's systematic strategies at dalyassetmanagement.com.

Disclosures: This newsletter is for informational purposes only and does not constitute investment advice. Past performance is not indicative of future results. Always conduct your own due diligence or consult with a financial advisor before making investment decisions.