- Daly Asset Management

- Posts

- Save Thousands Annually on Advisory Costs

Save Thousands Annually on Advisory Costs

How you can save thousands of dollars annually on advisory costs by switching today!

Save Thousands Annually on Advisory Costs

I’ll cut through the BS and just get straight to it.

See the table down below? That’s how much money you can save just by switching your advisor (for free) today.

The table assumes you have a current 1.00% annual advisory fee, as well as a roughly 0.50% fee charged by the actual funds your advisor is placing you in. Both of which are fairly standard for a traditional investment advisory, but either add or subtract a little depending on how much money you have invested, as advisors tend to offer graduated fees to larger clients.

Annual Fee Savings

Assets | Annual Savings |

|---|---|

$50,000 | $250.00 |

$100,000 | $500.00 |

$250,000 | $1,250.00 |

$500,000 | $2,500.00 |

$1,000,000 | $5,000.00 |

$2,500,000 | $12,500.00 |

Missed out compounding!

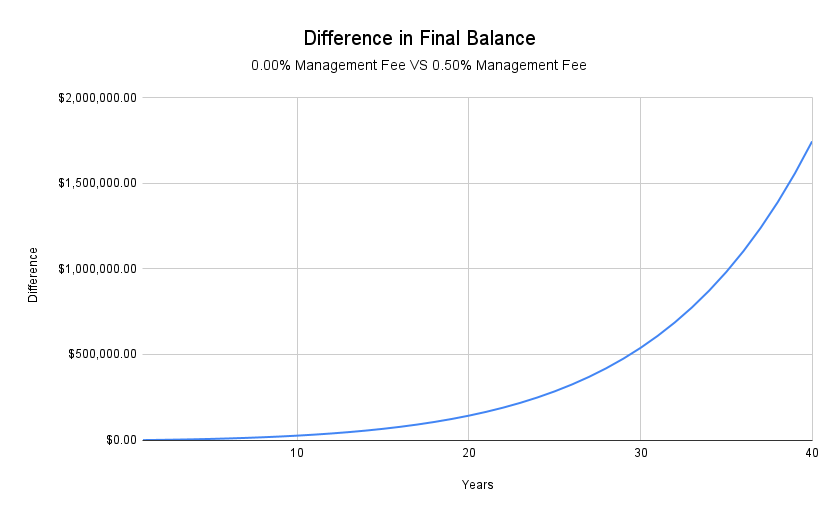

With $250k starting balance and $15k injected annually

The worst part isn’t even the fee paid! It’s the missed out compounding due to your fee being deducted.

Over 40 years, a 0.50% percent difference in return makes up over $1,750,000 in a portfolio with the description provided. And it’s not much better for smaller portfolios, in fact, that loss is more noticeable for smaller portfolios.

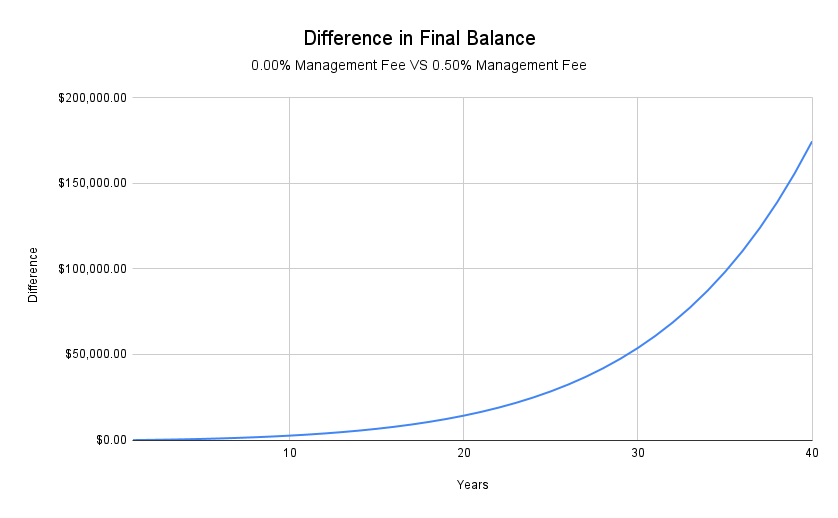

For a portfolio with just $25k invested, and 1.5k added annually, it makes a whopping $175,000 difference over the same 40 years.

With $25k starting balance, and $1.5k injected annually

Convinced yet that this fee needs to go? Well it’s actually easy to remove.

How is this fee removed?

So what’s the deal? Where can I go to just get a free fee reduction? Well, first I’ll cover how we do it.

Say your typical advisor charges 1.00%, as we assumed. We don’t get rid of that- in fact, we leave it just how it is- transparently, that will be how we make our money. Instead, we cut out the lesser thought about, much more out of the way 0.50% fee that your actual funds charge you.

Assume you’re invested in mutual funds A, B, and C, and each of those funds own 3 different stocks. Well, the funds charge you roughly 0.50% annually just for holding those stocks, as that used to actually be a difficult thing to manage, as trading stocks used to be costly, time consuming, and a whole other job. However with modern technology, it can now be done automatically.

We cut out the mutual funds. If fund A owns stocks X, Y, and Z, at 33.33% each, we can have software just buy us the underlying stocks, and now we don’t pay the 0.50% annual fee, which as you can see above, really adds up!

Where to go?

Daly Asset Management, partnering with Quantbase, is offering investors the ability to link an existing brokerage account, or deposit funds, and gain access to a plethora of active or passive investment strategies, and cut out the sizable fee that’s passed through by holding funds. We will be going live in early September on dalyassetmanagement.com, but for now, you can test the waters with our Active Growth Strategy already live on Quantbase, and make sure to subscribe to this newsletter for reminders on when we go live!