- Daly Asset Management

- Posts

- Monday Investor Newsletter July 7th

Monday Investor Newsletter July 7th

Daly Asset Management Monday Investor Newsletter

Last week commentary

The shortened trading week of June 30th through July 3rd saw a 2% rally in the S&P 500, beating the tech heavy QQQ’s 1.6% rise. Deswell, $DSWL ( ▲ 0.28% ) , our stock of the week last week, saw a 17.5% jump in value (including it’s dividend payment,) over just four trading days, driving significant returns for holders of our Quantbase strategy. While underperforming the market as of the last update (June 22nd,) since then, Deswell, General Motors, and M/I Homes, (making up a combined 37.5% of the portfolio,) alone contributed 9.5% in returns to our strategy, visible to all our current investors. The total portfolio increased in value more than 10.5% last week, beating the S&P by just under 9% in a four day period.

On Tuesday Powell said “that the Fed would have cut by now were it not for tariffs.” (CNBC) confirming theories that the Fed is concerned about the potential inflationary pressures that have been set in motion but have yet to show in backward looking figures.

In other news, the US dollar rallied sharply on Thursday after jobs came in hot, supporting Powell’s (say it with me now) “Higher for Longer” stance.

On the reported 147k month over month increase in jobs, the dollar jumped an impressive 73 basis points against the Japanese Yen, a fairly impressive move for a major FOREX pair, with slightly smaller, but still significant 50 basis point move against the Swiss Franc.

Unemployment was 4.1%, against a predicted 4.3%, causing a jump in the market prior to open, quite interesting considering the market is practically all-in on the idea of a rate cut, something that a hot job market dissuades, but who am I to second guess the complete rationality of humans.

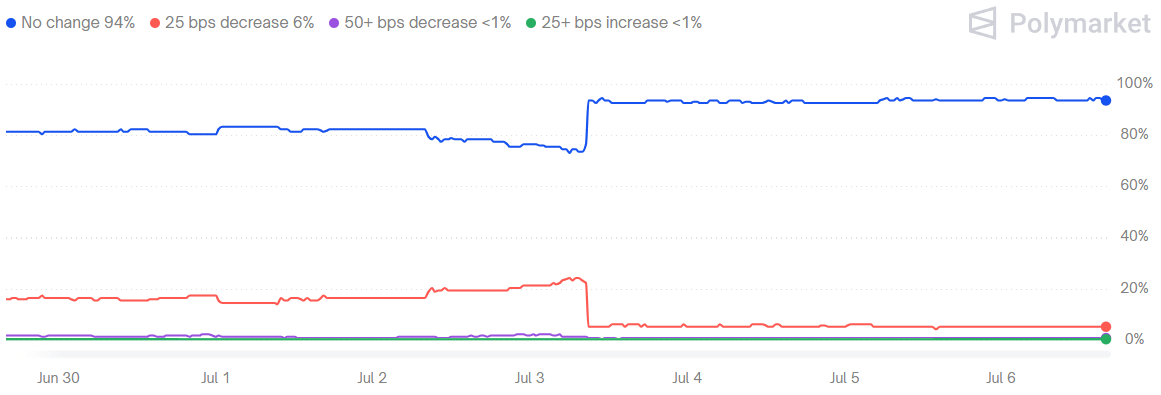

Below is a graphic showing the rapid change in the markets belief that the Fed will cut rates in July, with the possibility for a cut dropping sharply from 26% to just 6% upon the job data being released.

Polymarket “Fed decision in July?” contract

The S&P also moved higher, which, given the near reliance the current markets valuation has on rate cuts, has further widened the gap between reality and the market’s current 30x P/E valuation.

Other than Powell speaking, and job data being released last week, it was a fairly quite week, with neither of the aforementioned two being exceptionally outside of expectations. The market continued to burst through to all time highs, nearing a yearly RSI of 76, with >70 being considered “overbought.” The MACD shows a differing sign, however as the MACD tends to require a small correction to trigger, the RSI might be more reliable here, officially a bearish signal.

I don’t want to cry wolf, or that the SPY is falling, but I consider the market, especially large caps, to be concerningly overvalued considering Trump’s economic instability has already proven capable of dragging the market down significantly.

The Fear Index, $VIX ( ▲ 10.06% ) , which measures premiums on options contracts, (which tend to be correlated with volatility,) has reached February lows, and VIX call options may be a good hedge for those more savvy investors looking to buy insurance against another spook.

Stock of the Week: $DSWL

Introduction

Deswell Industries, a stock trading below $3.00 per share, commands a fair value of $6, and could potentially unlock this valuation in the near future. So what does this $2.50 microcap stock have that I saw? Well let’s dive in!

Deswell Industries, Inc. produces injection-molded plastic parts and components, and engages in assembly of electrical products, metallic molds, and accessories. The company was founded in 1987 and is headquartered in Macau, China. Looked at in the early 2000's by Michael Burry, Deswell has attracted value investors for over two decades, grabbing my eye due to its high cash balance, and the extent to which it was undervalued encouraged further research, which suggested there was a sizable opportunity to exploit.

With a dividend yield of 8%, Deswell clearly has a significant amount of cash handy, but the amount relative to its market cap will likely surprise you. With a market cap of just under $40M, Deswell holds over $96 million (USD equivalent) worth of current assets, comprised primarily of marketable securities, time deposits, and accounts receivable, and when subtracting $9 million (USD equivalent) to account for inventories, Deswell holds over $83 million (USD equivalent) worth of highly liquid current assets, ~$5.20 a share, more than double Deswell's current share price.

Throughout this free analysis, I'll discuss the potential reasons for Deswell's low valuation relative to our $6.00 price target, the risks inherent to investing in a company of this size, and the potential reward of being a long term holding in Deswell, a holding you can gain significant exposure to through our DAM Core Top Five (Coming soon) strategy, as well as many more on our platform!

See the free analysis here: https://dalyam.beehiiv.com/p/stock-of-the-week-6-30-7-4

Highlighted Economic Events for the Week 07/07-07/11

Wednesday, July 9, 2025

10-Year Note Auction

Thursday, July 10, 2025

Initial Jobless Claims

30-Year Bond Auction

Highlighted Corporate Earnings Releases for the Week 07/07-07/11

Thursday, July 10, 2025

Progressive (PGR) 153.39B Market Cap

EPS Estimated 4.30

Revenue Estimated 20.50B

Final Notes

As we head into a week with the two main economic events being bond auctions, we encourage investors to watch rates, as that is where the Big Beautiful Bill’s market impact will be felt most significantly.

The potential increase in the yield curve driven by higher government borrowing could be seen in higher yields after the auctions for longer duration bonds, which will likely have markets split between doubling down on hopes of a rate cut, and cooling valuations off as higher yields pull investors out of higher risk assets like equities.

Deswell ($DSWL) continues to be our high-conviction value play, and we’ll be monitoring developments closely, including any movement on dividend policy. The sudden jump in price does not dissuade our bullish sentiment, and we reiterate our $6.00 a share price target.

If you haven’t already, be sure to follow us on X/Twitter and keep an eye on our upcoming platform launch at dalyassetmanagement.com, where you’ll be able to track price targets, follow new strategies, and dig deeper into our stock research.

See you Friday. Until then stay sharp, stay skeptical, and stay invested.

— Daly Asset Management