- Daly Asset Management

- Posts

- June 30th through July 3rd Weekly Recap

June 30th through July 3rd Weekly Recap

Daly Asset Management Weekly Investor Newsletter

Select Closing Prices for the Week 06/30-07/04

Index | Close | % Change |

S&P 500 | 6,279.35 | +1.70 |

Nasdaq 100 | 22,866.97 | +1.47 |

Dow Jones | 44,828.53 | +2.25 |

10-Year Yield | 4.275% | +0.073% |

Gold | $3,336 | +1.60 |

Bitcoin | $109,817.10 | +1.30 |

Equity Indices

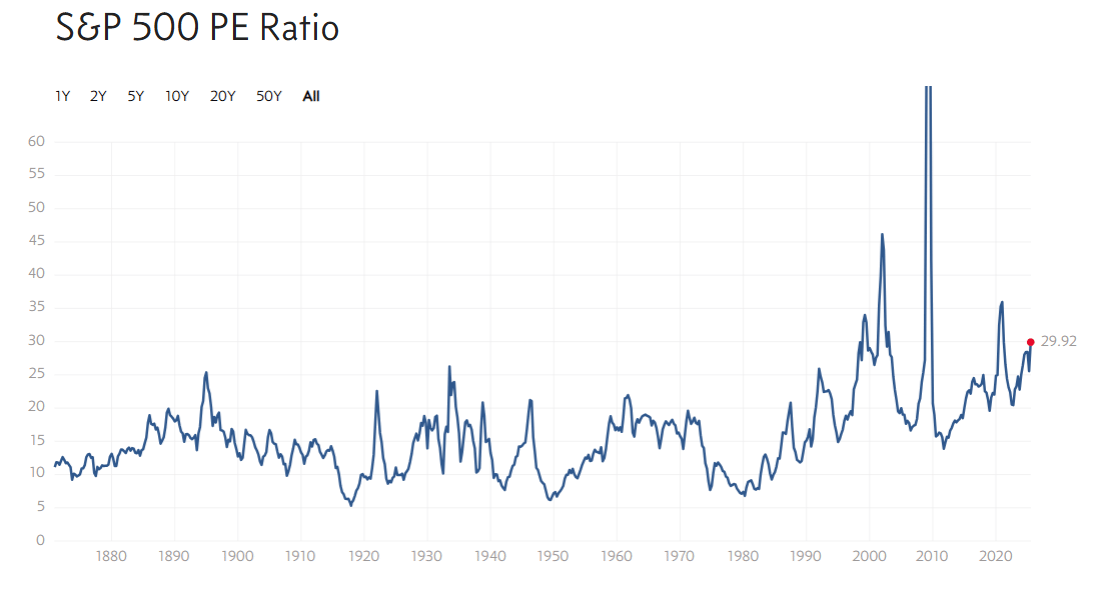

Breaking $160 a share, Nvidia hit an all time high Thursday, 07/03, driven by continued bullish sentiment in the markets. The S&P rallied to all time highs, as did the NASDAQ 100. The S&P 500 momentarily hit a 30x price/earnings ratio on Thursday, before settling at 29.92x.

Equity Indices Bigger Picture

The market is clearly expecting higher than average growth over the coming years, likely driven primarily by advancements in artificial intelligence increasing margins for companies that successfully implement it. However this could be overestimating the value that investors place on earnings rather than growth.

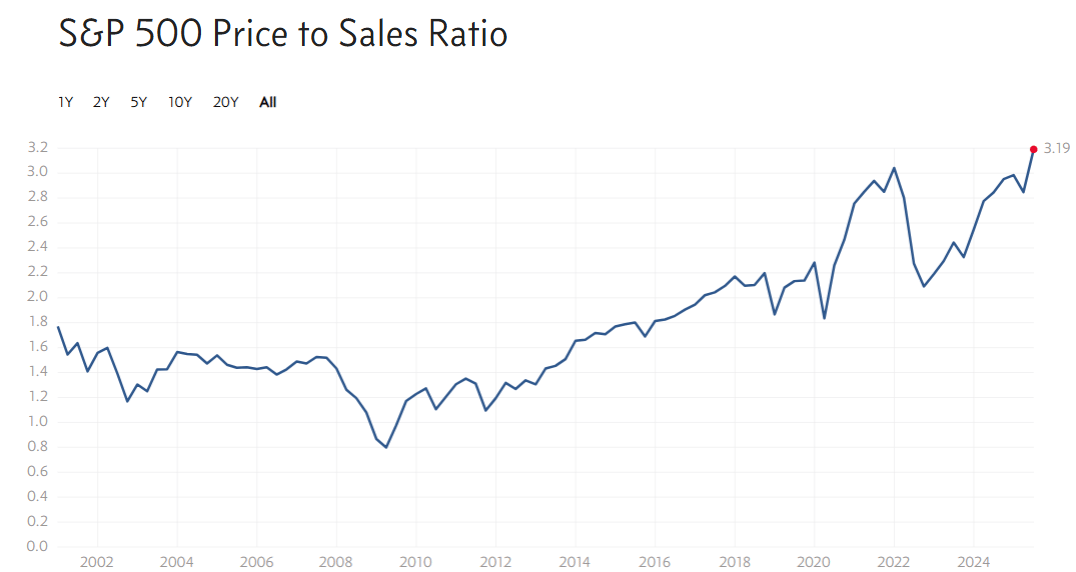

Margins can only expand to 100%, revenue growth is what truly gives companies the valuations that they are currently demanding. The increase in price to sales is even more significant than the increasing P/E ratio, driving upwards past all time highs to 3.19x, well above the historical average, but in line with the trend of the last decade as companies see that aforementioned valuation expansion.

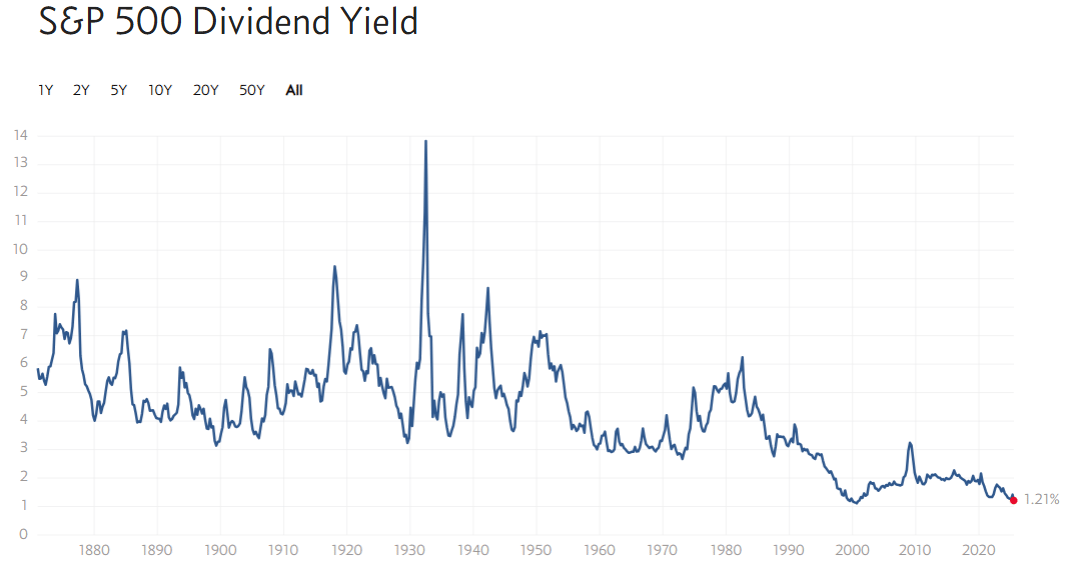

The S&P 500 also has the second lowest dividend yield in history, being only beat at the height of the dot-com bubble, by just 0.1%.

It’s clear to me that the index is priced for excessive growth over the coming years, a situation that by definition prices its constituents for perfection. Whether or not this is a view that I consider reasonable is irrelevant, as is my market outlook. Instead what matters is whether or not this environment suits your particular style of investing and risk tolerance. It is likely that there will be significant turnover in the markets as companies growth starts to materialize (or not,) and investors rush into the new top-dogs of the market.

10-Year Yield

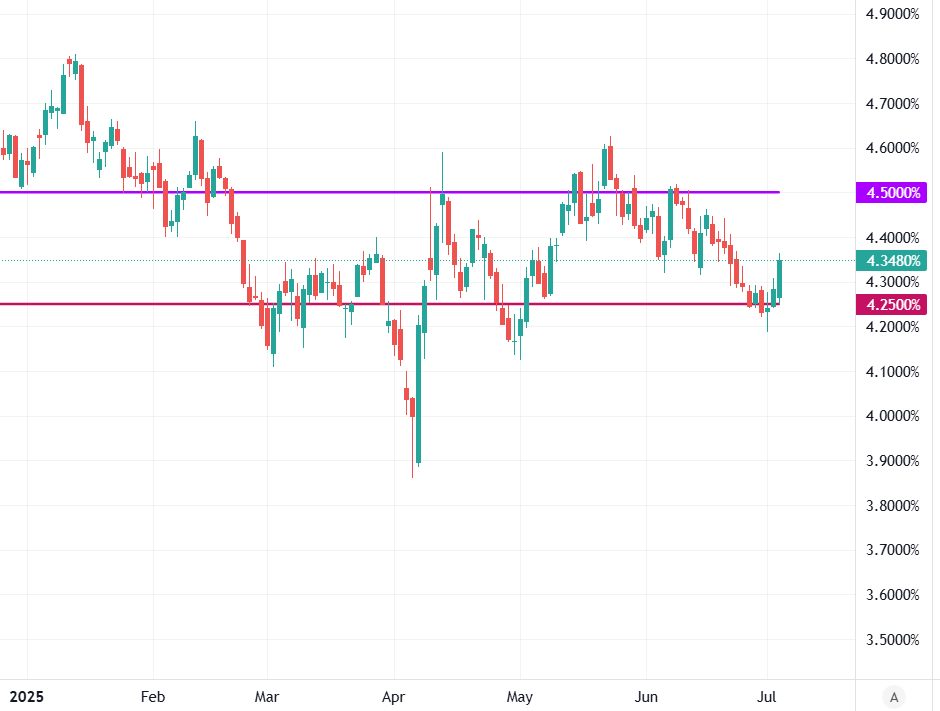

The 10-Year treasury yield rallied this week, bouncing off the lower bound of the federal funds target rate, after jobs came in hot, supporting the feds “higher for longer” rate policy. The US dollar rallied sharply against the Yen and Franc after being beaten down the majority of last week.

Gold

Gold is likely to continue to perform well as a store of value against a weakening dollar. Rarely do I encourage people to invest in “hard assets” and “stores of value,” but with the Big Beautiful Bill passing, and the US deficit not showing any signs of declining, the dollar certainly has some headwinds against its appreciation relative to assets of fixed value.

Bitcoin

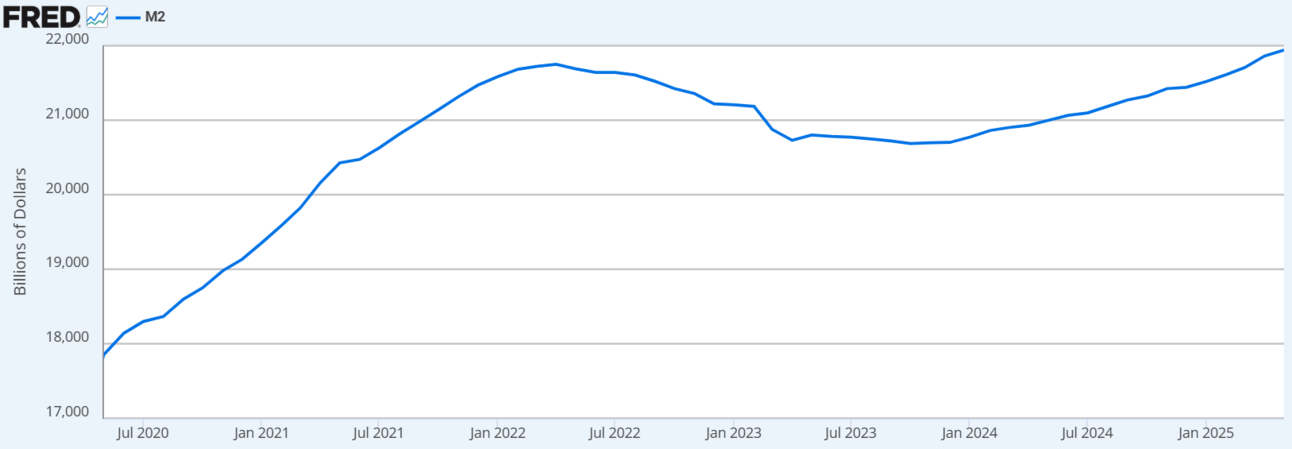

Bitcoin is likely to enter an extremely bullish environment, likely roaring past $150k by end-of-year. In an inflationary environment, typically, rates are hiked, lowering money supply. This is not the case however when rates are actively being driven down by the president and by economic catastrophes brought on by poor policy such as Trump’s trade war. In an environment where the Fed is forced to cut rates, or even keep them at current levels, and inflation soars due to a large federal deficit and hot jobs, the money supply is going to push Bitcoin higher yet.

Stock of the Week: $DSWL

Introduction

Deswell Industries, a stock trading below $3.00 per share, commands a fair value of $6, and could potentially unlock this valuation in the near future. So what does this $2.50 microcap stock have that I saw? Well let’s dive in!

Deswell Industries, Inc. produces injection-molded plastic parts and components, and engages in assembly of electrical products, metallic molds, and accessories. The company was founded in 1987 and is headquartered in Macau, China. Looked at in the early 2000's by Michael Burry, Deswell has attracted value investors for over two decades, grabbing my eye due to its high cash balance, and the extent to which it was undervalued encouraged further research, which suggested there was a sizable opportunity to exploit.

With a dividend yield of 8%, Deswell clearly has a significant amount of cash handy, but the amount relative to its market cap will likely surprise you. With a market cap of just under $40M, Deswell holds over $96 million (USD equivalent) worth of current assets, comprised primarily of marketable securities, time deposits, and accounts receivable, and when subtracting $9 million (USD equivalent) to account for inventories, Deswell holds over $83 million (USD equivalent) worth of highly liquid current assets, ~$5.20 a share, more than double Deswell's current share price.

Throughout this free analysis, I'll discuss the potential reasons for Deswell's low valuation relative to our $6.00 price target, the risks inherent to investing in a company of this size, and the potential reward of being a long term holding in Deswell, a holding you can gain significant exposure to through our DAM Core Top Five (Coming soon) strategy, as well as many more on our platform!

See the free analysis here: https://dalyam.beehiiv.com/p/stock-of-the-week-6-30-7-4