- Daly Asset Management

- Posts

- Daly Asset Management Friday Investor Newsletter

Daly Asset Management Friday Investor Newsletter

AI is priced in. But solar infrastructure, rare earths, and defense-grade supply chains? Still early. Nextracker is one of our highest-conviction plays yet.

Corporate Overview

Daly Asset Management specializes in equity portfolio construction and investment management. We serve as General Partner of affiliated investment vehicles and develop differentiated strategies across research, advisory, and capital deployment — all focused on long-term value creation and scalable, systematized investing.

Launching soon at dalyassetmanagement.com, our platform gives investors access to high-conviction strategies, real-time performance tracking, and transparent decision-making — no hidden fees, no sales agenda.

We specialize in:

Deep value and GARP strategies rooted in fundamental research

Income models using dividends, covered calls, and synthetic bond ladders

Tactical and thematic portfolios targeting macro dislocations and structural change

Whether you're a self-directed investor, advisor, or allocator — our tools are built for those who think independently and invest intentionally.

Last Week Snapshot: July 7–11, 2025

Index Performance

Index | Level | Weekly Change |

|---|---|---|

S&P 500 | 6,334.50 | +0.39% |

Nasdaq 100 | 23,045.50 | +0.16% |

Dow Jones | 45,024.00 | +0.68% |

Bitcoin | $113,220 | +1.94% |

Gold | $3,326 | +0.15% |

10-Year Yield | 4.344% | +0.002 pts |

Markets nudged higher despite geopolitical headlines and shifting policy risks. Small caps outperformed large caps. Market breadth improved slightly, though volatility indicators remain compressed.

Market Commentary

Nvidia Hits $4T. Trump Revives Tariffs. The Market Moves On.

Nvidia briefly touched a $4 trillion valuation — a milestone that generated more LinkedIn posts than price movement. The stock closed up just 0.52%. Investors aren’t shocked anymore. At this point, Nvidia is a benchmark, not a battleground.

Meanwhile, Trump reintroduced tariffs with a vengeance. Brazil is now facing a 50% import tax starting August 1. Copper, coffee, and orange juice futures all spiked. The Brazilian real sank 2.4% overnight. But markets barely blinked.

Why? Because investors don’t believe it will last. Tariffs are being priced as political theater — not structural change. That’s a mistake. If these measures expand to India or Europe, the supply chain impact will be real and persistent.

Beyond headlines, the Fed is losing control of expectations. Jobless claims dropped to 227,000 — suggesting a tight labor market — yet the yield curve is already pricing in 2025 cuts. The 10-Year Treasury sits a full 25 basis points below the Fed Funds rate.

That’s not a soft landing. That’s a policy credibility gap.

Geopolitical Undercurrents

Defense Is Quietly Being Redefined

While the media focused on tariffs, the Department of Defense quietly acquired $400 million in preferred equity in MP Materials (MP), becoming its largest shareholder.

This wasn’t a bailout — it was a strategic resource play. Rare earths are essential for EVs, chips, and weapons systems. And 70% of U.S. supply still comes from China.

Washington has moved from outsourcing to ownership. This isn’t just about defense contractors anymore. It’s about upstream control — rare earths, magnets, metallurgical refining. Investors should pay attention.

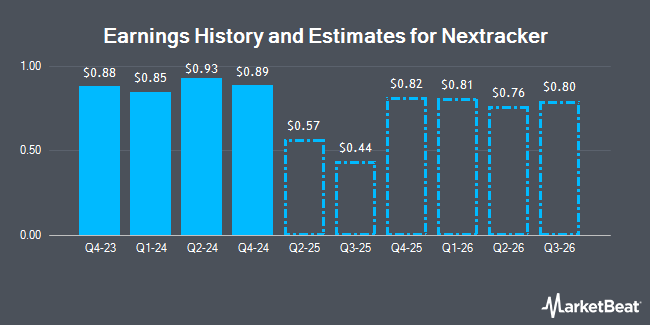

Stock of the Week: Nextracker (NXT)

NASDAQ: NXT | Market Cap: $9.8B | Sector: Clean Tech Infrastructure

While many investors chase AI software or ESG momentum plays, Nextracker offers something different: execution. Their solar tracking systems physically optimize panel positioning, increasing energy yield at utility scale. This isn’t theory — it’s the hardware behind some of the world’s largest solar farms.

Fundamentals:

Backlog growth: +46.5% over two years

FCF margin: +13.6 percentage points over five years

ROIC: Rising steadily

Debt: Minimal; balance sheet positioned for scale

Valuation: Trading at a discount to long-term installed base potential

Why Now?

As the Inflation Reduction Act continues to roll out tax credits, demand for domestic solar infrastructure is ramping. Nextracker benefits from both cyclical stimulus and secular demand. It is one of the rare clean tech names not dependent on subsidies to survive.

This is a rare combination of backlog, free cash flow, and policy tailwind — all at a reasonable multiple.

Theme to Watch

Defense Stocks Are the New Energy Trade

The DoD’s equity move into MP Materials signals a broader transition: defense investing is shifting from contractors to commodities. Materials like niobium, cobalt, and rare earths are now strategic assets.

Expect this trend to continue. As the global economy fragments, and BRICS realignment deepens, nations will race to secure upstream inputs.

Defense names to watch:

Rare earths and magnets: MP, Lynas

Tooling and semicap: AMAT, ACLS

Energy/logistics overlays: HAL, PLTR, ASTS

This isn’t a short-term trade — it’s a shift in national security doctrine. Allocation flows are just beginning.

Forward View: July 14–19, 2025

Key Economic Events

Retail Sales (Jul 16): +0.3% MoM expected. Surprise upside may challenge rate cut narratives.

Housing Starts + Building Permits (Jul 17): Indicators of domestic resilience.

Initial Jobless Claims (Jul 18): Watching for continued sub-230K strength.

Earnings to Watch

Netflix (NFLX): Monetization of anti-password policy

Goldman Sachs (GS): Fixed income + IPO pipeline outlook

Taiwan Semiconductor (TSM): Cleanest read on global AI infrastructure demand

Daly Asset Management Updates

We’re nearing the release of dalyassetmanagement.com, which will feature:

Real-time strategy dashboards

Public price target tracking

Deep dive investment notes

Access to DAM thematic models

More details coming soon.

Final Notes

The market is treating rising valuations and rising geopolitical risk as mutually exclusive. That’s not likely to hold. If you’re not pricing in macro volatility, you’re not playing the same game as the people running countries.

Nextracker offers real fundamentals in a market drunk on hype. Defense stocks are breaking out under the radar. And tariffs — despite being old news — are back with real teeth.

Stay skeptical. Stay strategic. And remember — when everyone agrees, something’s probably wrong.

Coming soon to dalyassetmanagement.com

Systematized investing. No noise. No kickbacks. Just data.

Disclosures: This newsletter is for informational purposes only and does not constitute investment advice. Past performance is not indicative of future results. Always conduct your own due diligence or consult with a financial advisor before making investment decisions.